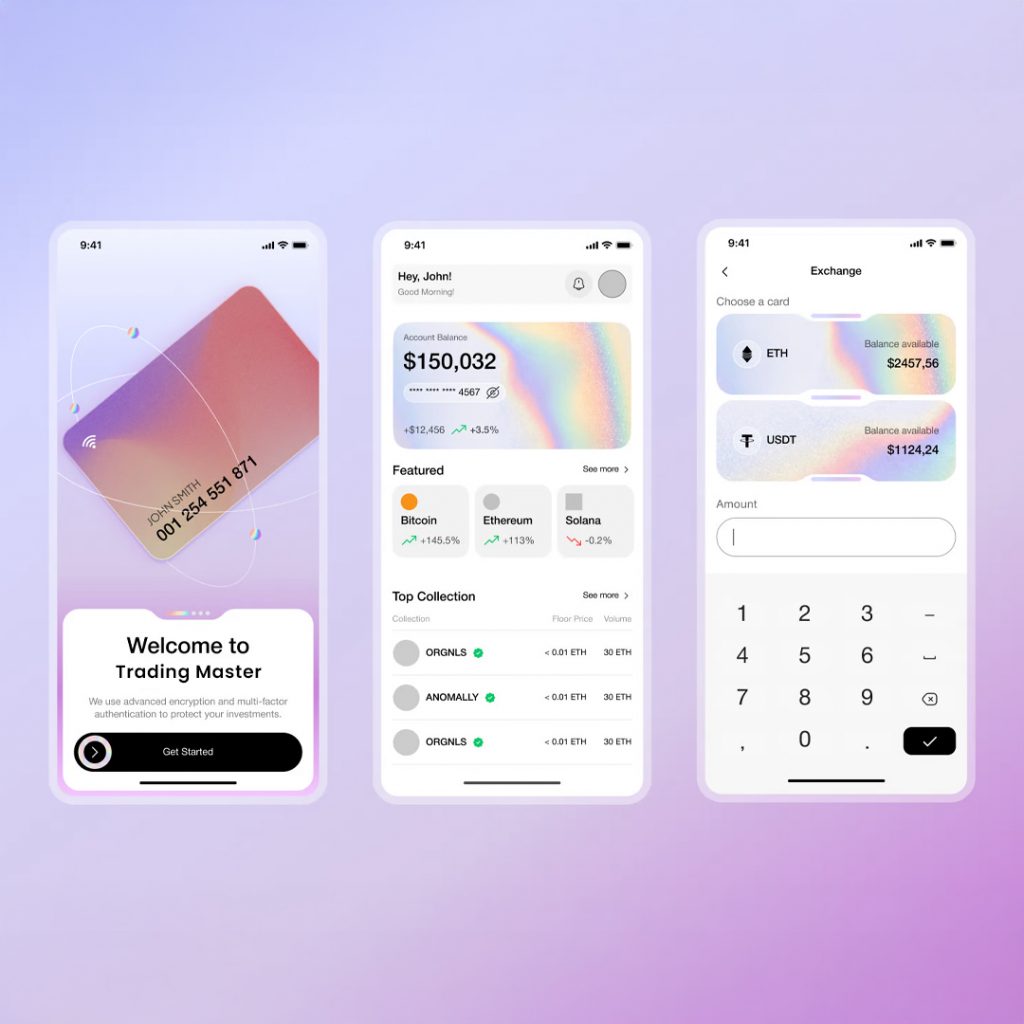

In the world of finance and investments, the need for secure, real-time, and scalable trading apps is more significant than ever. The global trading market is growing rapidly, and businesses need platforms that can handle high-frequency transactions, provide seamless user experiences, and adhere to the highest security standards. If you’re looking to develop a trading app that can handle complex financial data and real-time market movements, you need a solid plan in place to ensure both security and scalability.

How to Build a Secure and Scalable Trading App:

Building a trading app is not a one-size-fits-all project. There are several key components, technologies, and best practices involved that ensure your app can scale with user demands, secure financial data, and provide an optimal trading experience. In this guide, we’ll walk you through the step-by-step process of building a secure and scalable trading app and explain how Srishta Technology can help you achieve your app development goals.

Why Build a Trading App?

Before diving into the process, it’s essential to understand the growing demand for trading apps in the current market. Trading apps allow users to access the financial markets and execute trades on-the-go. These apps offer several benefits:

-

Convenience: Traders can manage their investments and execute trades from anywhere in the world.

-

Real-time updates: Trading apps provide real-time access to stock prices, market movements, and financial news.

-

Customization: Users can tailor their experience based on their trading preferences, from advanced charting tools to algorithmic trading features.

For businesses, a well-designed trading app can increase market reach, attract new users, and increase revenue through various monetization models. However, the app’s success depends on ensuring that it is secure, scalable, and easy to use.

Stock Trading App Development

Step 1: Understanding the Core Features of a Trading App

The first step in building a secure and scalable trading app is understanding what features are essential for a trading platform. The following features are critical for any trading app:

1. Real-Time Market Data

Trading apps require real-time access to market data, including stock prices, forex rates, commodities, or cryptocurrencies. This data must be continuously updated without any delay to ensure that traders can make informed decisions.

-

API Integrations: Your app should integrate with financial data APIs (e.g., Yahoo Finance, Alpha Vantage, Bloomberg) to provide live market data.

2. Secure Payment Gateways

Security is paramount when dealing with financial transactions. The app must support secure payment gateways for depositing and withdrawing funds, such as integration with banks, digital wallets, or cryptocurrency exchanges.

-

SSL Encryption: Ensure end-to-end encryption for secure transactions.

-

Multi-Factor Authentication (MFA): To secure users’ accounts and transactions, integrate 2FA and other authentication methods.

3. Advanced Charting and Analytics Tools

Traders often use charts, indicators, and technical analysis tools to make trading decisions. The app should support real-time charts, candlestick patterns, and other technical indicators.

-

Integration with TradingView API: This allows you to incorporate advanced charting features and indicators into your app.

4. Order Management and Execution

Your app must facilitate the execution of buy and sell orders with minimal latency. This includes features like limit orders, stop-loss orders, and market orders.

5. Push Notifications

Push notifications keep users engaged by alerting them to significant market events, order executions, or price fluctuations.

-

Real-time alerts: For price movements, order status, or market news.

6. User Account Management

Your app must provide a secure way for users to manage their accounts, track their trading history, and access financial statements.

-

Profile management: Allow users to update personal information and manage security settings.

-

History tracking: Enable users to track previous trades, profits, and losses.

7. Risk Management and Margin Trading

Integrate features like margin trading, where users can borrow funds to increase their trading capacity. Risk management tools, such as stop-loss limits, can help prevent significant losses.

Step 2: Choosing the Right Technology Stack

The success of your trading app depends heavily on the technology stack you choose. Below are the key components you should consider when selecting the right tech stack for your trading app:

1. Frontend Development (UI/UX)

The user interface (UI) is where traders will interact with your app, so it’s crucial to create an intuitive and engaging design. Use frameworks and technologies like:

-

React Native or Flutter (for cross-platform mobile apps)

-

Swift (for iOS apps)

-

Kotlin or Java (for Android apps)

-

Angular or ReactJS (for web apps)

2. Backend Development

For a trading app to be scalable and efficient, your backend needs to handle high volumes of data and user traffic. Some popular backend technologies include:

-

Node.js for high performance and scalability.

-

Ruby on Rails for rapid development.

-

Python (Django/Flask), which is great for handling data-heavy applications.

-

Java (Spring Boot) for handling complex business logic and large-scale applications.

3. Real-Time Data Streaming

Trading apps require real-time data processing. For this, you can use technologies like:

-

WebSocket for bi-directional real-time communication between the server and the client.

-

Kafka for high-throughput messaging.

-

Redis for real-time data caching and pub/sub.

4. Database and Data Storage

The database should be able to handle vast amounts of transactional data. Popular choices for financial apps include:

-

SQL databases like MySQL or PostgreSQL for structured data.

-

NoSQL databases like MongoDB or Cassandra for unstructured or large-scale data storage.

5. Cloud Infrastructure

Cloud platforms are ideal for ensuring the scalability of your trading app. Some of the best cloud providers include:

-

AWS (Amazon Web Services)

-

Google Cloud

-

Microsoft Azure

-

Heroku (for smaller applications)

6. Blockchain for Secure Transactions (Optional)

If you plan to offer cryptocurrency trading, integrating blockchain technology into your app provides enhanced security and transparency for transactions. Blockchain can also reduce fraud and speed up transaction processing.

Step 3: Ensuring Security Measures

Since trading apps deal with sensitive financial data, security is paramount. Below are some essential security measures to consider:

1. Encryption

Ensure that all data exchanged between the client and server is encrypted using SSL/TLS. Additionally, sensitive information such as passwords, payment details, and transaction history must be AES-256 encrypted at rest.

2. Multi-Factor Authentication (MFA)

Implement MFA for logging into accounts and authorizing transactions. This adds an extra layer of protection and reduces the risk of unauthorized access.

3. Anti-Money Laundering (AML) & Know Your Customer (KYC) Compliance

Your trading app must comply with KYC regulations to verify the identity of users. Use third-party services for identity verification, including document uploads, facial recognition, and ID verification.

4. Tokenization

Incorporate tokenization for payment and transaction processing to protect sensitive financial data from being exposed.

5. Regular Audits and Penetration Testing

Regularly conduct security audits and penetration testing to identify vulnerabilities and ensure your app is not susceptible to hacks or data breaches.

Step 4: Scalability Considerations

A successful trading app must be able to handle rapid user growth and high-volume trading without compromising performance. Here’s how to ensure scalability:

1. Cloud Scalability

Leverage cloud infrastructure to ensure that your app can scale easily based on traffic. Cloud platforms like AWS and Google Cloud provide auto-scaling features to manage traffic spikes.

2. Load Balancing

Use load balancing to distribute incoming network traffic evenly across multiple servers, ensuring high availability and performance during periods of heavy traffic.

3. Database Sharding

If your app stores large amounts of data, implement database sharding to distribute data across multiple servers, reducing the load on any single database and improving performance.

Trading Software Development Company

Step 5: Testing and Deployment

Once your app is built, thorough testing is essential to ensure everything works as expected. Testing should include:

-

Unit testing for individual functions and components.

-

Integration testing for data flow and functionality between modules.

-

Security testing to identify vulnerabilities.

-

Load testing to simulate high traffic and ensure scalability.

Once the app passes all tests, it can be deployed to the cloud or app stores for distribution.

How Srishta Technology Can Help You Build a Secure and Scalable Trading App

At Srishta Technology Pvt Ltd, we specialize in building custom, secure, and scalable trading apps tailored to meet your specific business needs. Our team of expert developers ensures that your trading app is:

-

Highly secure with the latest encryption and authentication standards.

-

Scalable to handle millions of users and high-frequency transactions.

-

Compliant with the latest financial regulations and industry standards.

We guide you through the entire development process—from ideation and design to deployment and maintenance. Our goal is to deliver an app that not only meets your users’ needs but also provides you with a robust platform for growth.

Trading Platform Software Development Services

FAQs

1. What technologies should I use to build a secure trading app?

For security, use SSL/TLS encryption, multi-factor authentication (MFA), and data encryption (e.g., AES-256) for transactions. You should also consider implementing blockchain technology for transparency in transactions.

2. How can I ensure my trading app is scalable?

To ensure scalability, use cloud infrastructure for easy scaling, implement load balancing, and use database sharding to distribute data load. This will ensure your app can handle increased traffic and user load.

3. What are the common challenges in building a trading app?

Common challenges include managing real-time data, ensuring security for financial transactions, integrating with payment gateways, and ensuring the app is compliant with financial regulations.

4. How do I monetize my trading app?

Common monetization strategies include offering subscription plans, charging transaction fees, or providing premium features such as advanced analytics and insights.

5. How long does it take to develop a trading app?

The development timeline varies depending on the complexity of the app. A basic trading app may take 3-6 months, while more complex platforms could take 9-12 months or longer.

Algo trading software development Company

Ready to Build Your Trading App?

If you’re looking for a trusted partner to develop a secure and scalable trading app, contact Srishta Technology today! Let’s turn your vision into reality.

Leave a Reply